Introduction

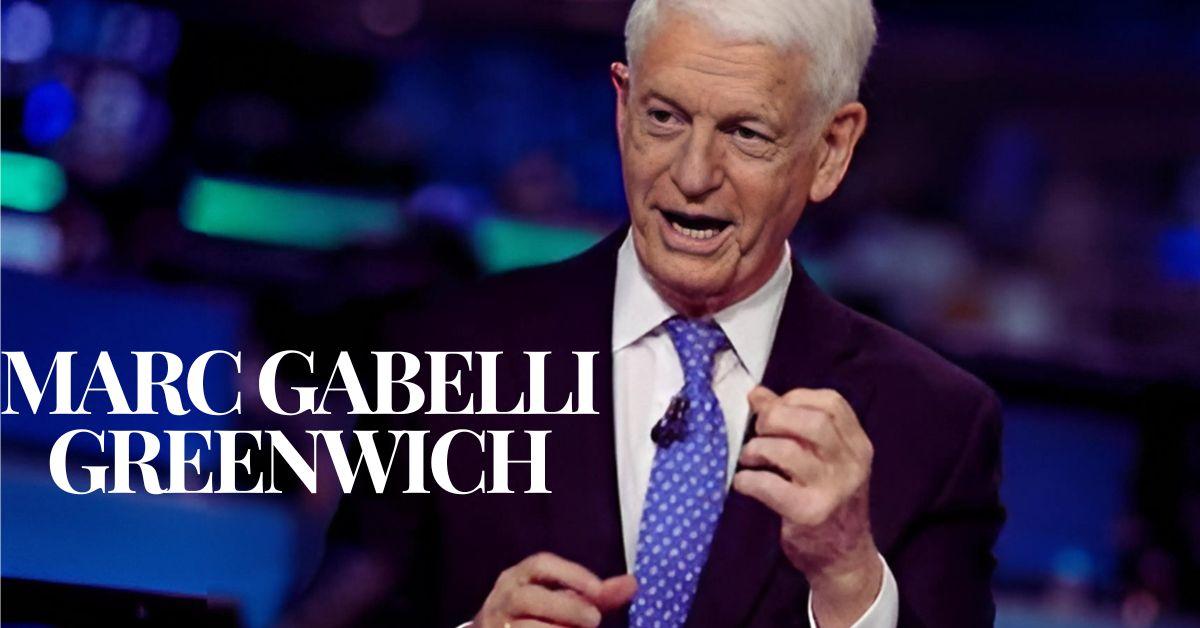

Marc Gabelli Greenwich is a prominent figure in the finance world, renowned for his expertise in investment management and value investing. As the founder of Gabelli Asset Management Company, he has built a legacy that transcends mere financial success. His life and work in Greenwich, Connecticut, where he has established his professional base and personal residence, provide a fascinating insight into his influence on both the financial industry and the local community. This article explores Marc Gabelli Greenwich background, his contributions to finance, his presence in Greenwich, and the broader implications of his work.

Early Life and Education

Background

Born in 1945 in the Bronx, New York, Marc Gabelli Greenwich was raised in a family that valued education and hard work. His father was a successful businessman, which instilled in him an early appreciation for entrepreneurship and investment. Growing up in a diverse urban environment, Gabelli was exposed to various cultures and ideas that shaped his worldview.

Education

Gabelli attended Columbia University, earning a Bachelor’s degree in Economics. His education was a critical foundation for his future career in finance. He further honed his skills at Columbia Business School, where he obtained an MBA. These experiences equipped him with the analytical tools necessary for navigating the complexities of investment and finance.

Career Beginnings

Early Professional Journey

Marc Gabelli’s career began in the 1960s at Loeb, Rhoades & Co., where he quickly developed a reputation for his investment acumen. He focused on analyzing undervalued companies, a strategy that would later define his investment philosophy. His time at Loeb, Rhoades was instrumental in shaping his understanding of the market and building a network of influential contacts.

Founding Gabelli Asset Management

In 1977, Marc Gabelli Greenwich founded Gabelli Asset Management Company. His vision was to create a firm that emphasized value investing, a strategy focused on purchasing stocks at prices below their intrinsic value. This approach requires thorough research and analysis, and Gabelli’s firm quickly gained recognition for its disciplined investment strategies. Under his leadership, the company has grown to manage billions in assets across various investment vehicles, including mutual funds, hedge funds, and institutional accounts.

Investment Philosophy

Value Investing

Marc Gabelli Greenwich is a staunch advocate of value investing, a strategy that involves identifying undervalued stocks based on fundamental analysis. This philosophy emphasizes buying quality companies at discounted prices, allowing for significant upside potential. Gabelli’s rigorous research process includes evaluating a company’s financial health, market position, and growth prospects.

Long-Term Perspective

A hallmark of Gabelli’s investment approach is his focus on long-term growth. He believes that successful investing requires patience and a willingness to weather market fluctuations. This long-term perspective has allowed Gabelli to achieve impressive returns for his clients over the decades.

Sector Specialization

Marc Gabelli Greenwich has developed expertise in various sectors, including media, telecommunications, and consumer products. His ability to identify promising companies within these industries has contributed to his firm’s success. Gabelli’s research team is known for producing detailed reports that guide investment decisions.

Gabelli in Greenwich

The Appeal of Greenwich

Greenwich, Connecticut, is known for its affluent community and picturesque landscapes. The town has become a hub for finance professionals, attracting some of the industry’s most successful individuals. Gabelli’s decision to establish his firm and residence in Greenwich aligns with the area’s reputation as a center for wealth management and investment.

Community Involvement

Marc Gabelli Greenwich is not only a business leader but also an active participant in the Greenwich community. He has contributed to various local initiatives and charities, demonstrating his commitment to giving back. Gabelli’s philanthropic efforts often focus on education, health, and the arts, reflecting his belief in the importance of supporting community development.

Impact on Local Economy

Gabelli Asset Management’s presence in Greenwich has had a positive impact on the local economy. The firm employs numerous professionals, contributing to job creation and economic growth in the area. Additionally, Gabelli’s reputation in the finance world has helped elevate Greenwich’s status as a premier destination for investment management.

Philanthropic Endeavors

Commitment to Education

One of Marc Gabelli’s primary philanthropic focuses is education. He has made significant contributions to various educational institutions, including Columbia University. Gabelli believes that fostering a strong educational foundation is essential for developing future leaders in finance and business.

Support for the Arts

Marc Gabelli Greenwich has also shown a deep appreciation for the arts, supporting initiatives that promote cultural enrichment in the Greenwich area. His contributions to local arts organizations have helped fund programs that enhance the community’s cultural landscape, providing residents with access to artistic experiences.

Health Initiatives

In addition to education and the arts, Gabelli has supported health initiatives in the community. His philanthropic efforts in this area demonstrate his commitment to improving the quality of life for residents in Greenwich and beyond.

Challenges and Criticisms

Market Volatility

Like all investors, Marc Gabelli Greenwich has faced challenges due to market volatility. Economic downturns and market fluctuations can significantly impact investment performance. However, Gabelli’s long-term approach has generally enabled him to navigate these challenges successfully.

Industry Competition

The asset management industry is highly competitive, with numerous firms vying for investor attention. Gabelli Asset Management must continuously adapt to changing market conditions and client needs to maintain its competitive edge. This ongoing challenge requires constant innovation and strategic planning.

Reputation Management

In the finance industry, reputation is everything. Marc Gabelli Greenwich must ensure that Gabelli Asset Management maintains a strong reputation for integrity and performance. This involves transparency in operations, consistent communication with clients, and adherence to ethical standards.

The Legacy of Marc Gabelli

Influence on Value Investing

Marc Gabelli Greenwich has made a significant impact on the field of value investing. His disciplined approach and commitment to thorough research have influenced countless investors and finance professionals. Many aspiring investors look to Gabelli as a role model, seeking to emulate his success and investment strategies.

Teaching and Mentorship

Beyond his professional achievements, Gabelli has taken on a mentorship role, sharing his insights and experiences with others. He frequently participates in lectures, workshops, and industry conferences, contributing to the broader discourse on finance and investment.

Inspiring Future Generations

Gabelli’s commitment to education and philanthropy has helped inspire future generations of finance professionals. By investing in educational initiatives and supporting programs that promote financial literacy, he is empowering young people to succeed in an increasingly complex financial landscape.

The Future of Gabelli Asset Management

Growth and Expansion

As Gabelli Asset Management continues to grow, the firm is likely to explore new opportunities for expansion. This could involve launching new investment products, entering emerging markets, or leveraging technology to enhance investment strategies. Gabelli’s forward-thinking approach positions the firm well for future success.

Embracing Technology

The finance industry is undergoing a technological transformation, and Gabelli Asset Management must adapt to these changes. Embracing technology, such as data analytics and artificial intelligence, can enhance the firm’s investment decision-making processes and improve operational efficiency.

Commitment to Sustainability

As sustainability becomes increasingly important in the investment world, Gabelli Asset Management may focus on incorporating environmental, social, and governance (ESG) factors into its investment strategies. This shift aligns with the growing demand for responsible investing and can enhance the firm’s reputation among socially conscious investors.

Conclusion

Marc Gabelli Greenwich journey from a young boy in the Bronx to a leading figure in finance is a testament to his hard work, dedication, and strategic thinking. His impact on the investment landscape, particularly through Gabelli Asset Management, has been profound. Based in Greenwich, Connecticut, Gabelli has not only built a successful career but also made significant contributions to the local community and beyond.

Through his commitment to education, the arts, and health initiatives, Marc Gabelli Greenwich exemplifies the importance of giving back and supporting community development. His legacy in value investing, mentorship, and philanthropy continues to inspire future generations of finance professionals.

As the investment landscape evolves, Marc Gabelli’s influence is likely to endure. His innovative approach to investing, dedication to long-term growth, and commitment to making a positive impact on society position him as a prominent figure in the finance world for years to come.